Capital turnover is a measure that shows how efficiently a specific business uses its financial resources to generate sales and gain revenue. It aims at revealing the potential profit a company can bring with the given funds for its day-to-day operations.

Why is capital turnover important?

Entrepreneurs often seek to find out how much revenue their future business can generate. Therefore, before making investments, shareholders calculate how much money their equity can bring during the year.

Although the capital turnover ratio may seem generalized, it demonstrates how efficiently a brand uses its invested capital to generate sales and obtain profit. A high ratio shows that the business effectively utilizes the invested money, and everything is running smoothly. A low ratio indicates that a company uses invested funds ineffectively (too much inventory and accounts receivable), resulting in debts or obsolete inventory.

If a business doesn't have a high working capital turnover ratio, it may experience a lack of funds for everyday operations and short-term debts. Managing your working capital enables you to stay aware of your business's accounts payable and receivable and control them. Besides, it helps allocate funds so that they can be used efficiently.

Now that we have set that straight, let's proceed to calculations of capital turnover.

How to Calculate Capital Turnover

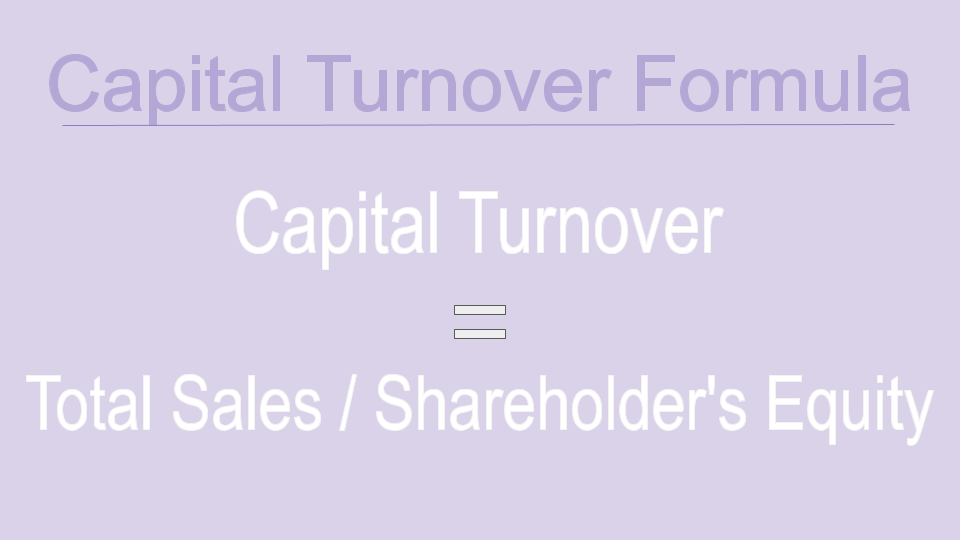

Companies use the capital turnover ratio as an indicator of efficiency with which a business uses its assets to generate profit. Below you can find a capital turnover formula.

Where

- total sales are the annual sales of a company;

- shareholder's equity is the number of funds invested by stockholders from the beginning till the date of capital turnover calculations.

The higher the ratio, the more efficient a business is at generating sales and receiving revenue. If the ratio is low, it shows that a company uses its funds inefficiently. In this case, you should consider several steps that can help you improve this indicator.

How to Improve Capital Turnover

- Fulfill your debt obligations

- Find vendors that provide discounts

- Analyze your business spendings

- Review your interest payments

- Limit the number of inventory

- Avoid conflicts with customers and vendors

- Ensure you have relevant financial information

To procure raw materials, pay salaries, ensure that production meets demand, any company needs working capital. It's crucial to improve the working capital position because businesses often experience a lack of funds for everyday operations. Therefore, there's a need for a firm to monitor the cash flow for having enough funds to pay off short-term debts without losing ROI in assets. Let's walk you through several ways to increase your working capital.

- Fulfill your debt obligations. Remember, meeting all debt obligations is critical for good business functioning. To provide timely payments, you can use online payment systems. They allow you to avoid a delay in payments that might result in a penalty.

- Find vendors that provide discounts. If you have vendors that can give you a discount on products, you can save some money. Do your best to build strong relationships with your vendors. In case of financial problems with your company, this relationship can help you receive a discount or some other kind of help.

- Analyze your business spendings. Define whether there's a possibility of reducing fixed and variable costs. By conducting a thorough analysis, you can find the unnecessary spendings. Remove those costs to have more liquidity for working capital.

- Review your interest payments. Revise your interest rate for different types of debts. You should check whether it's possible to change the interest rate and pay a smaller amount every month. Besides, timely payment of debts can significantly reduce the number of payments in the future.

- Limit the number of inventory. There's no point in buying a lot of inventory if it idles in your warehouse. When purchasing products from vendors, you should estimate how much of these you can sell. Moreover, it makes sense to reduce the production of goods that aren't popular among customers.

- Avoid conflicts with customers and vendors. If any disputes arise between you and customers or vendors, make everything possible to resolve them quickly. A case going to court can result in additional costs and a bad reputation.

- Ensure you have relevant financial information. You should always keep your financial statements and reports updated. It allows you to be aware of your company's financial position and find out what requires improvement.

To conclude, knowing your capital turnover allows you to discover whether your business generates sales and brings you revenue. To manage your company and resources efficiently, you need to be aware of the capital turnover. You can easily calculate the ratio by using the formula from this article and decide whether your business needs some improvements.

or