Total cost is the sum of expenses a company needs to manufacture a specific level of output. It’s a total of fixed and variable costs, calculating which helps product managers evaluate their overall profit margin.

Business owners should possess information about profits and expenses to reassure that their companies are running smoothly. Total cost gives entrepreneurs an understanding of their firms’ profitability and performance. In this article, we’ll reveal several steps necessary to calculate the total cost and discuss an example.

How to Calculate Total Cost

Different types of businesses leverage the formula to evaluate their overall profit margin. If a firm doesn’t bring the expected revenue, it’s up to its owner to decide whether to make any changes to turnover or pricing. So if you need to obtain the measure, let’s review four steps to calculate it for your company.

- Sum up all fixed costs. First of all, you need to determine the fixed costs of your company. These are business expenses that aren’t influenced by the number of manufactured products or services. They include machinery, property taxes, equipment, rental or lease payments, etc. Once you know your fixed costs, sum them all up.

- Find all variable costs. The next step is to figure out the variable costs. These refer to expenses influenced by the number of products manufactured by a particular company. Expenses on raw materials, utility costs, packaging, wages, and commissions are examples of variable costs. Therefore, you need to obtain a total of these expenses.

- Add all fixed and variable costs to define the total cost. Once you have all your fixed and variable costs, you can estimate the total cost by adding all these expenses.

- Check the income statement to find your business’s costs. Financial documents contain records about the performance of a certain company and its business activities. That’s why it may be helpful to check an income statement to find information on the costs of a business. Besides the income statement that nearly every company has, you might need to consult a balance sheet to check your company’s financial health.

Now that you know the necessary steps to calculate the total cost, let’s proceed to the example.

Total Cost Example

Businesses use the formula to obtain this metric that enables them to assess their profitability. Business owners compare total costs at different time intervals to figure out whether a firm needs to boost sales, review pricing, or generate more revenue.

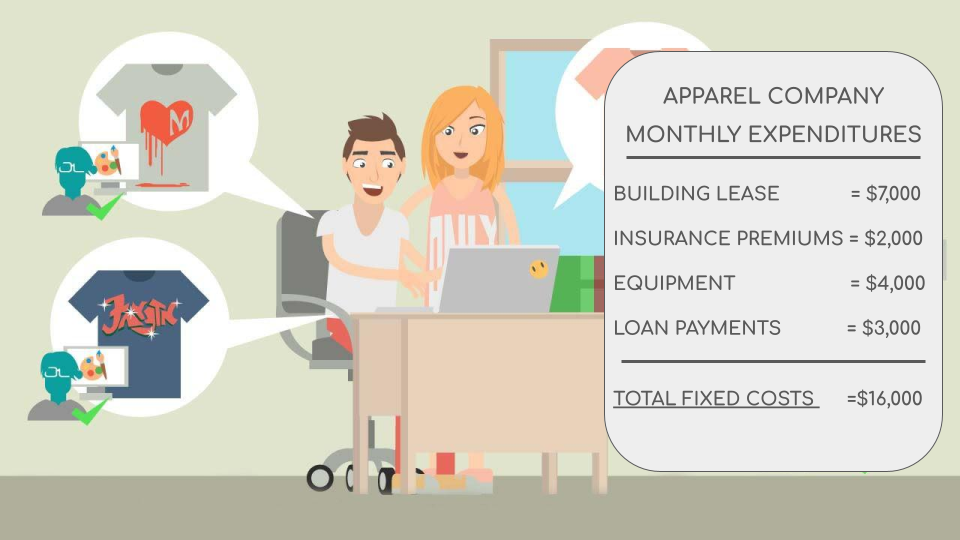

Let’s imagine that there’s an apparel company. The owner of this business needs to calculate the total cost to determine whether the firm brings any profit. For this purpose, there is a necessity to obtain all fixed costs of this business. You can see them below.

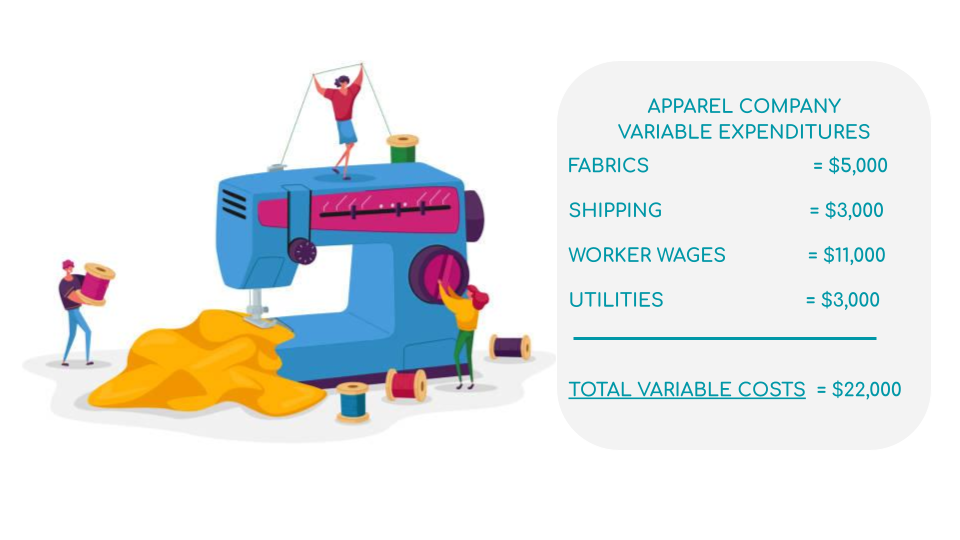

The second step is to find all variable costs and sum them up.

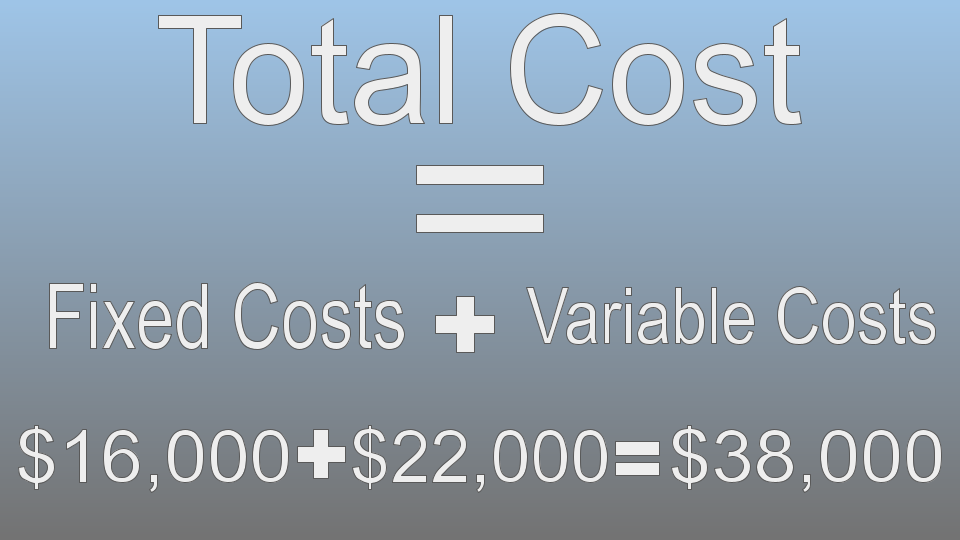

Now when you have the necessary measures, you can easily estimate the total cost by adding all of the expenses.

Hence, total cost helps entrepreneurs define the profitability of their companies. Taking this metric into account also helps assess a company’s performance and determine its position in the market compared to competitors’. The results can be used to review how successful a particular product or product range is.

Resources:

- This article defines the term, reveals how total cost works, and covers its advantages and disadvantages.

- This article provides readers with the definition of this metric and the formula to calculate it.

- This article contains information about the difference between fixed cost, total fixed cost, and variable cost.

or